unlevered free cash flow yield

Here is a step-by-step example of how to calculate unlevered free cash flow free cash flow to the firm. View Johnson Johnsons Unlevered Free Cash Flow Yield trends charts and more.

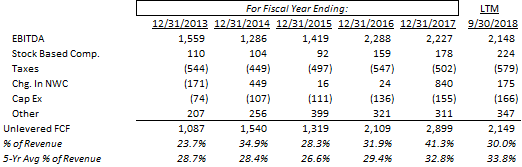

To demonstrate the formula to calculate unlevered free cash flow involves UFCF EBITDA T CE Increase in NonCash Working Capital Depreciation and Amortization Where EBITDA.

. How does nulls Unlevered. Begin with EBIT Earnings Before Interest and Tax Calculate the. NIKEs unlevered free cash flow yield for fiscal years ending May 2018 to 2022 averaged 27.

Salesforces latest twelve months unlevered free cash flow yield is 23. FCF Net Income Non-Cash Expenses Incrase in Working Capital Capital Expenditures. Get the tools used by smart 2.

In practical terms it would not make sense to calculate FCF all in one formula. Like levered free cash flow unlevered free. Teslas unlevered free cash flow yield for fiscal years ending December 2017 to 2021 averaged.

Step 1 Calculate Net Operating Profit After Tax. View Salesforce Incs Unlevered Free Cash Flow Yield trends charts and more. Unlevered free cash flow UFCF is the cash flow available to owners of all sources of capital equity-holders mezzanine financing owners and debtholders.

The formula for unlevered free cash flow yield includes earnings before interest taxes depreciation and amortization EBITDA as well as capital expenditures CAPEX. It represents the cash available. Lets calculate the yield of a potential investment from the perspective of a private equity firm.

Teslas latest twelve months unlevered free cash flow yield is 11. Free cash flow yield is similar in nature to the earnings yield metric which is usually meant to measure GAAP generally accepted accounting principles earnings per share. Johnson Johnsons latest twelve months unlevered free cash flow yield is 54.

Unlevered free cash flow is the free cash flow available to pay all stakeholders in a firm including debt holders and equity holders. The formula for unlevered free cash flow yield includes earnings before interest taxes depreciation and amortization EBITDA as well as capital expenditures CAPEX. There are numerous ways to calculate unlevered free cash flow but the most common approach is comprised of the following four steps.

Get the tools used by. The following section summarizes insights on s Unlevered Free Cash Flow Yield. NIKEs latest twelve months unlevered free cash flow yield is 24.

Dec 2013 Dec 2015 Dec 2017 Dec 2019 Dec 2021 00. A lower free cash flow yield is worse because that means there is less cash available.

Net Profit Ebitda Operating Cashflow And Free Cashflow In Dividend Investing

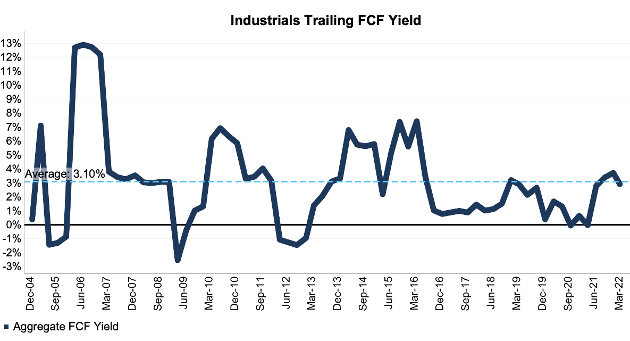

S P 500 And Sectors Free Cash Flow Yield Rises Above Pre Pandemic Levels Seeking Alpha

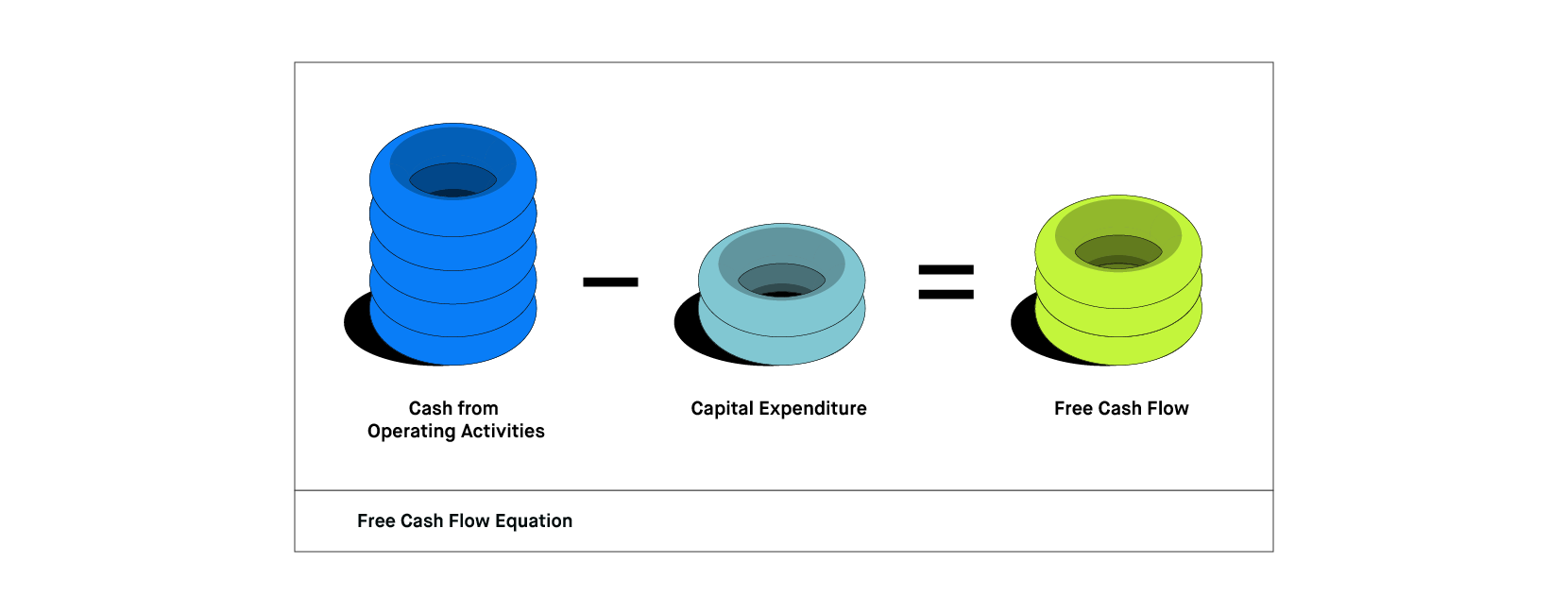

What Is Free Cash Flow Calculation Formula Example

What Is Free Cash Flow Robinhood

An Undervalued Free Cash Flow Generator To Start Your New Year Activision Blizzard Nasdaq Atvi Seeking Alpha

:max_bytes(150000):strip_icc()/Term-Definitions_freecashflow-5ec66f512895463a9f344f752fa3ce24.png)

Free Cash Flow Fcf Formula To Calculate And Interpret It

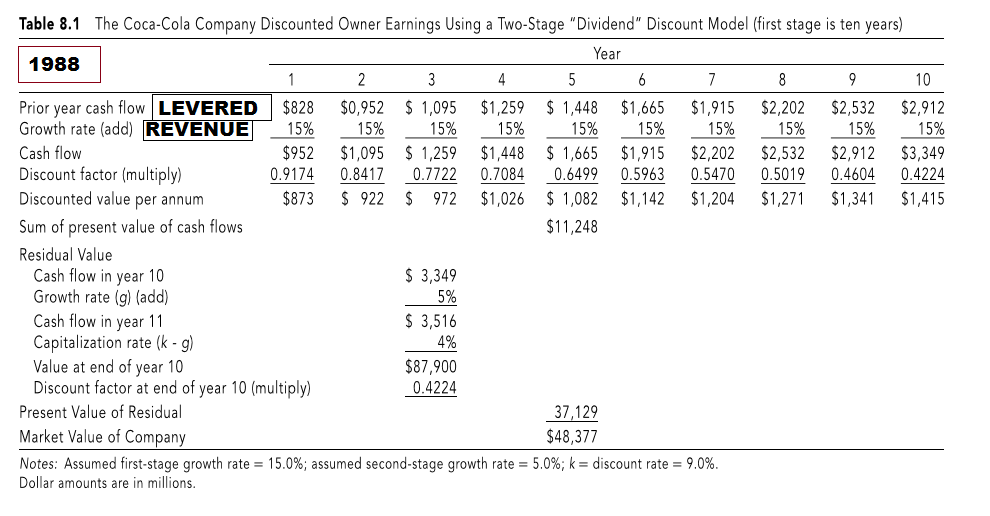

How To Use Levered Free Cash Flow And Revenue Growth To Analyze Stocks Seeking Alpha

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow Yield Definition How To Calculate Importance

Unlevered Free Cash Flow Ufcf Formula And Calculation

Levered Free Cash Flow Definition Examples Formula Wall Street Oasis

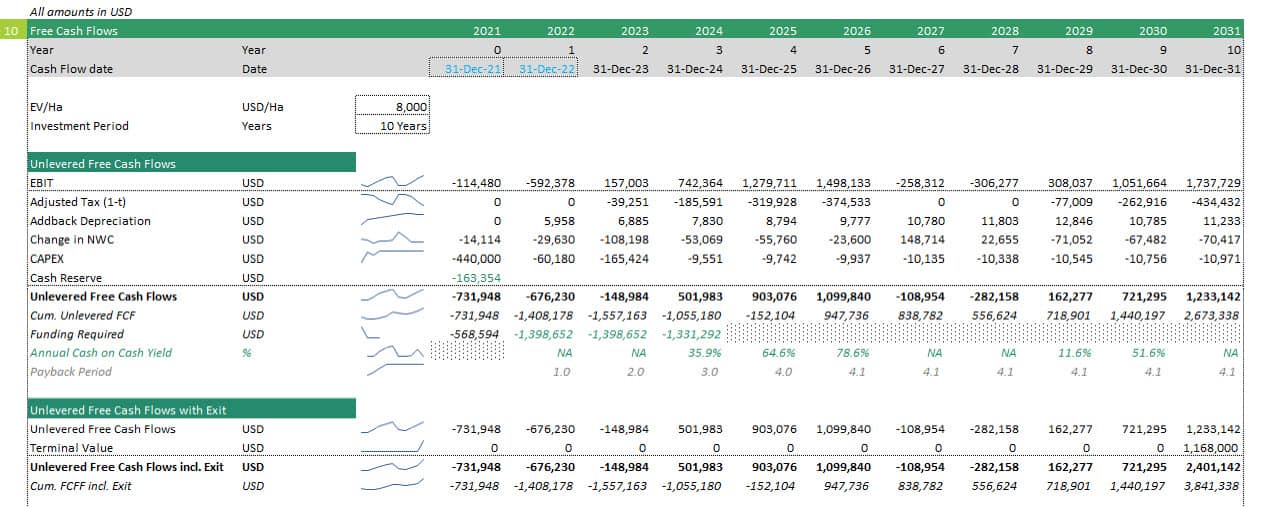

Banana Tree Farming Investing And Growing Efinancialmodels

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

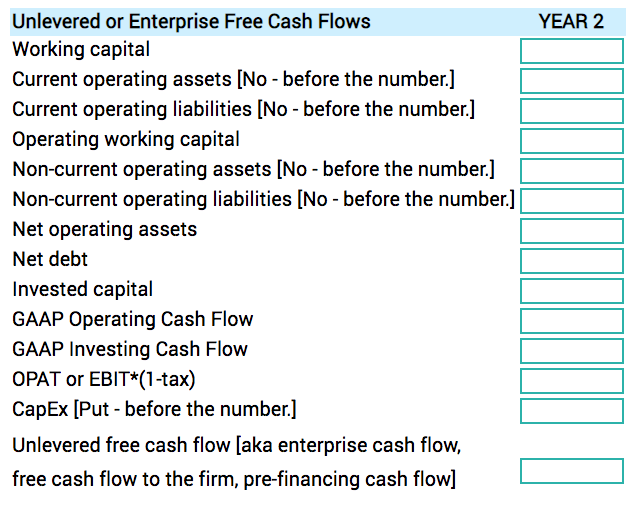

Year 1 Year 2 140 00 140 00 11123 00 2219 00 Chegg Com

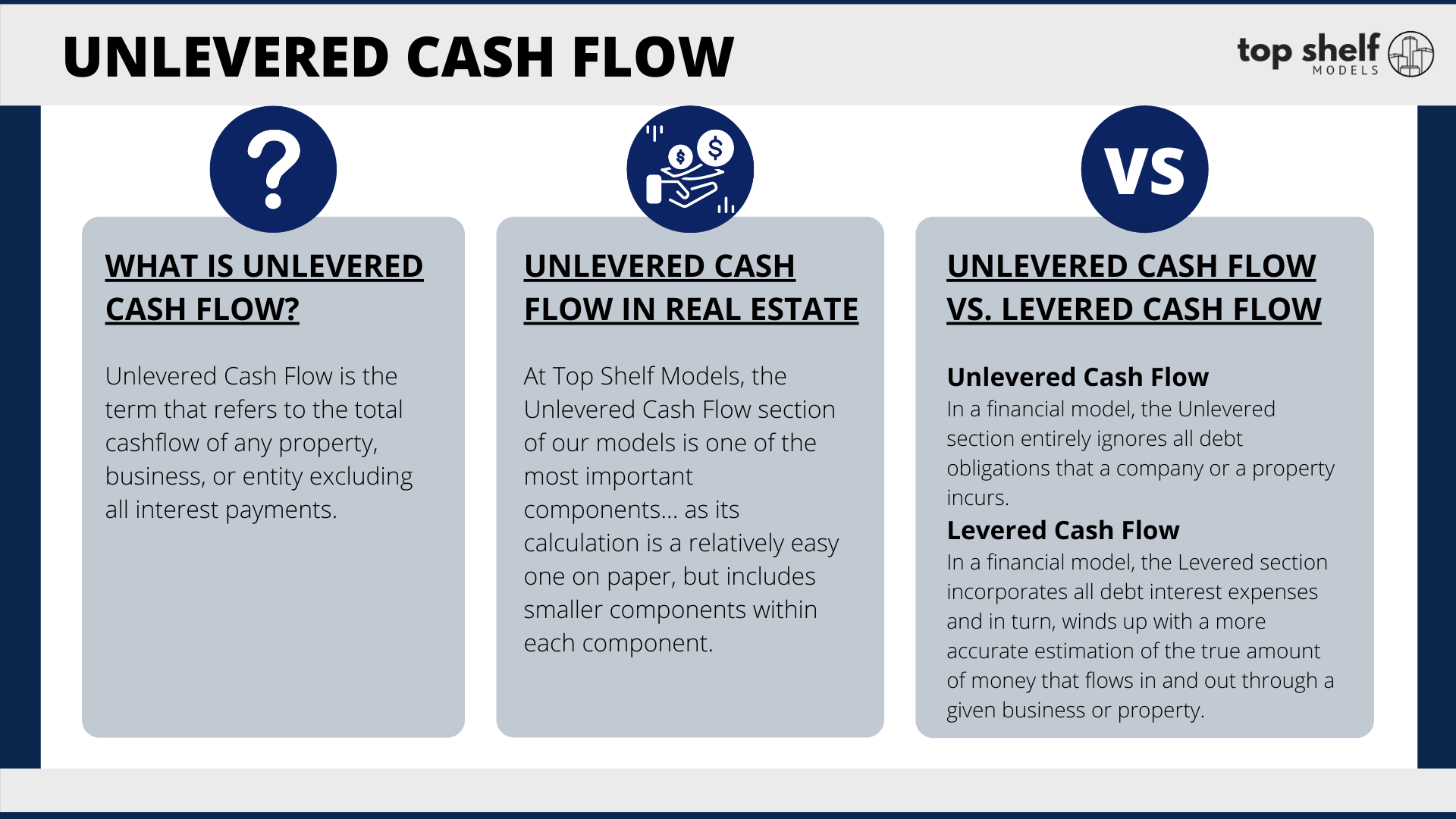

Understanding Unlevered Cash Flows In Real Estate Top Shelf Models

Drivers Of Unlevered Free Cash Flow Lumovest

When You Value Companies Using Free Cash Flow Yields Do You Use 1 Tev Fcf Or 2 P Fcf What Are The Benefits Disadvantages Of Each What Is The Typical Yield You Target Quora

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Why Yesteryear S Valuation Metrics Aren T Sufficient For Today S Mlp